Hello there, fellow ethical spenders! I’m Sarah Mitchell, your go-to source for all things ethical spending. For the past four years, we’ve explored various financial topics, from aligning tax strategies with our values to making responsible investment choices. Today, we’re embarking on a journey through the complex world of international tax planning and the ethical considerations that come along with it.

Now, I know the mere mention of “international tax planning” might make you want to grab your favorite cozy blanket and dive into a Netflix binge. But hang on, because understanding the ethical dimensions of this topic can be both enlightening and, dare I say it, even a bit entertaining.

The Global Tax Landscape: A Complex Web

Let’s start with the basics. International tax planning involves managing taxes across borders for individuals and businesses. It’s all about optimizing your tax obligations while staying on the right side of the law. And trust me, the global tax landscape resembles a labyrinth more than a straightforward path.

Imagine you’re a multinational corporation operating in multiple countries. Each country has its own tax laws, rates, and regulations. It’s like trying to solve a Rubik’s Cube while riding a unicycle – challenging, to say the least.

The Ethics of International Tax Planning

Now, here’s where it gets interesting. International tax planning often involves exploiting gaps and discrepancies between different countries’ tax codes. While these practices might be legal, they can raise ethical questions.

Tax Havens and Evasion vs. Avoidance

Let’s talk about the elephant in the room: tax havens. These are countries or territories known for their low or zero tax rates and relaxed financial regulations. While using tax havens isn’t necessarily illegal, it can certainly be ethically questionable.

For instance, imagine a multinational company that funnels its profits through a tax haven to minimize its tax liability. This may be legal, but it could also be seen as unethical since it shifts the tax burden onto other taxpayers, including small businesses and individuals.

On the flip side, tax avoidance, when done within the bounds of the law, is a legitimate strategy to reduce tax liability. But it’s a fine line between avoiding taxes and evading them, and the ethical implications depend on the specifics of the situation.

Transfer Pricing and Fairness

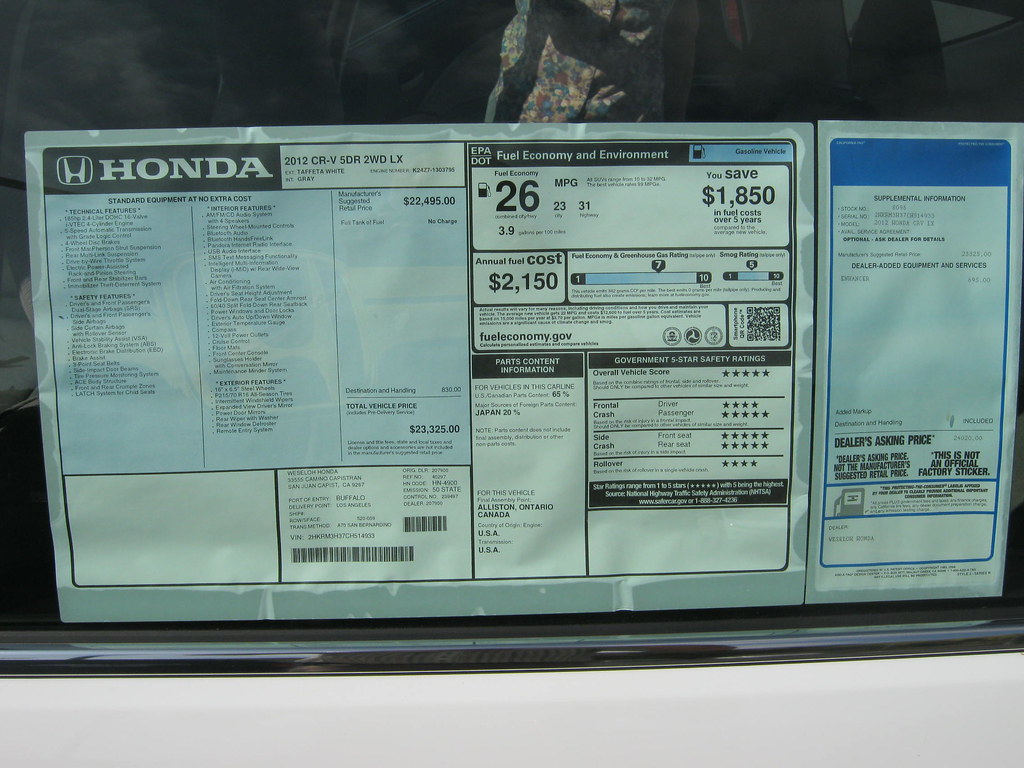

Another ethical concern in international tax planning is transfer pricing. This is when a multinational corporation sets the prices for goods and services between its subsidiaries in different countries. If not done fairly, it can lead to profit shifting and tax avoidance.

Imagine Company A, headquartered in the United States, sells its products to Company B, its subsidiary in a low-tax country, at an artificially low price. As a result, Company A reports lower profits in the U.S., reducing its tax liability there. This might be legal but raises questions about fairness and whether it’s ethically responsible.

Responsible Taxation

Ethical international tax planning isn’t just about minimizing taxes; it’s also about responsible taxation. This means paying a fair share of taxes in the countries where you operate, contributing to the communities and economies that support your business.

For instance, some multinational corporations have faced backlash for shifting profits away from countries where they generate substantial revenue. Ethical considerations come into play when companies prioritize profits over their societal obligations.

Advocating for Change

As ethical spenders, we can play a role in advocating for changes in international tax practices. Support efforts to close tax loopholes, increase transparency, and promote fairness in global taxation. By voicing our concerns and supporting responsible tax policies, we can push for a more ethical international tax landscape.

Putting Ethics into Action: A Real-Life Example

Let’s take a real-life example to illustrate the ethical dimensions of international tax planning. Imagine Company Z, a multinational tech giant with subsidiaries in various countries. Company Z has been criticized for using tax havens to reduce its overall tax bill, even though it generates substantial revenue in high-tax countries.

In response to public pressure and ethical considerations, Company Z decides to revise its international tax strategy. They increase transparency by disclosing their tax practices and commit to paying a fair share of taxes in the countries where they operate. This not only improves their ethical standing but also strengthens their reputation among consumers who value responsible corporate behavior.

In Conclusion

Navigating the world of international tax planning with an ethical compass can be challenging, but it’s essential for individuals and businesses committed to responsible financial practices. While it’s tempting to exploit legal loopholes and tax havens to reduce tax obligations, it’s equally important to consider the ethical implications of such actions.

Remember that ethics in international tax planning involve a delicate balance between minimizing taxes legally and paying a fair share to support the communities and economies where you operate. By advocating for responsible taxation, supporting transparency, and making ethical choices, we can contribute to a more just global tax system.

So, the next time you find yourself tangled in the web of international tax planning, remember that ethical considerations should guide your decisions. And who knows, you might just uncover a solution that benefits your bottom line and your conscience. Happy ethical spending, my fellow global citizens!