Hello there, dear readers! It’s Emily Anderson, your friendly neighborhood advocate for ethical spending, back with another enlightening piece. Today, we’re diving deep into the world of taxes – not the most riveting topic, I admit, but an essential one. I promise to sprinkle a bit of humor and a whole lot of insight into this subject, so stick around!

Now, when we think of taxes, we might picture stacks of paperwork, confusing forms, and the inevitable dread that comes with tax season. But guess what? Ethical tax practices can actually be quite fascinating. Yes, you heard that right! So, let’s embark on this journey together, and I’ll show you how to navigate the complex realm of taxes with integrity and a sense of purpose.

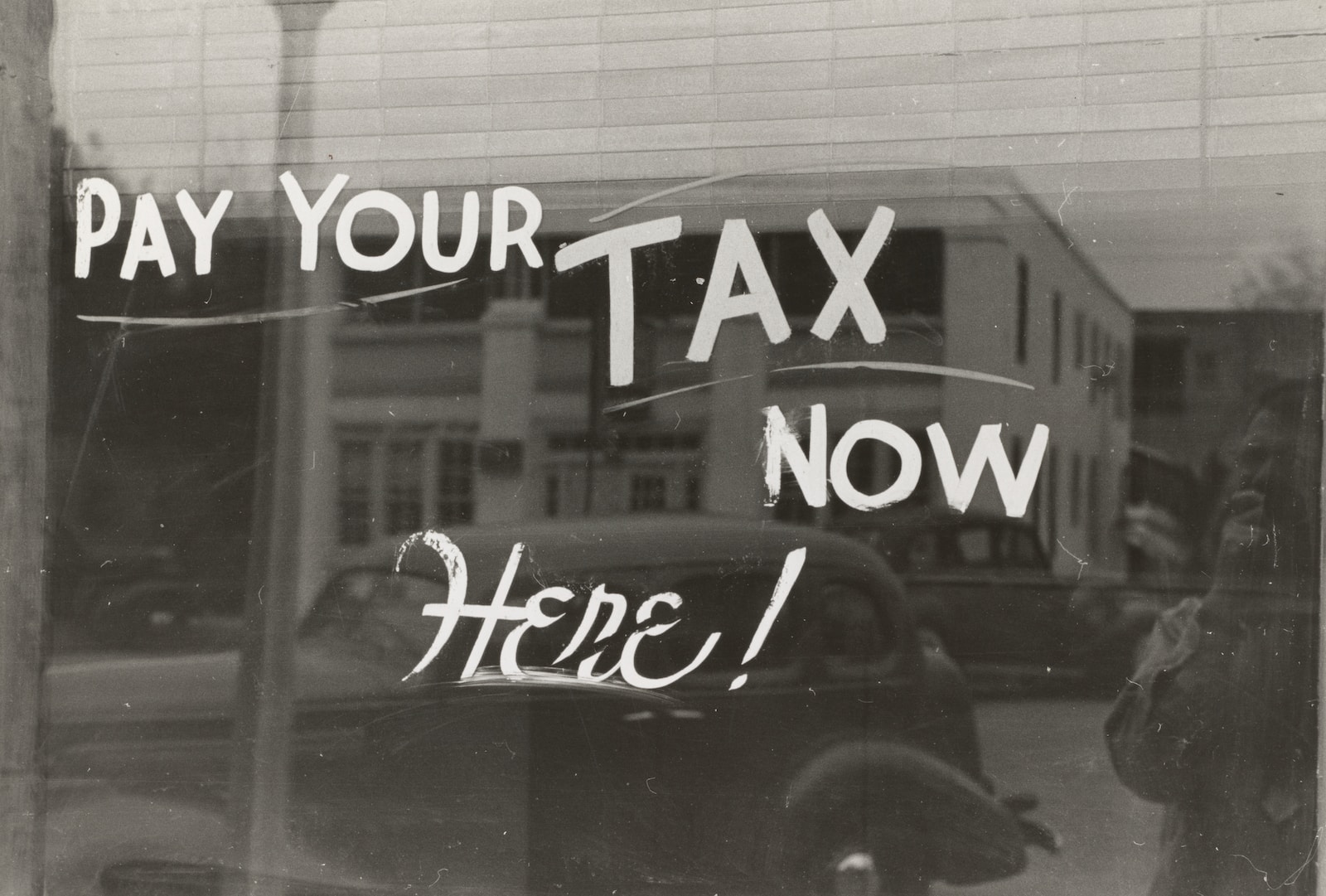

The Golden Rule: Pay Your Fair Share

Let’s start with the basics: paying your fair share of taxes. Think of taxes as your contribution to the greater good. Roads, schools, healthcare, and countless other essential services depend on the revenue generated from taxes. When you pay your fair share, you’re investing in the well-being of your community and your country. It’s like chipping in for a group gift – except in this case, the gift is a well-functioning society.

Understanding Tax Loopholes vs. Ethical Deductions

Now, here’s where things get a tad tricky. Tax loopholes – those sneaky shortcuts that allow some to reduce their tax bills significantly. But beware, not all tax breaks are created equal. Some are perfectly ethical, while others might be a bit, well, morally questionable.

Take the Earned Income Tax Credit (EITC), for instance. It’s a fantastic example of an ethical tax deduction. The EITC is designed to help low and moderate-income individuals and families. By taking advantage of this credit, you’re not gaming the system; you’re simply benefiting from a government program meant to assist those in need.

On the flip side, some tax loopholes can make even the most moral

ly upstanding citizen raise an eyebrow. Remember the Panama Papers scandal? That’s a prime example of exploiting tax havens to dodge taxes. So, the key takeaway here is to use deductions and credits for their intended purpose – to support the policies that align with your values.

Supporting Ethical Businesses

Now, let’s talk about where your money goes before it even reaches the taxman – your expenses. By supporting ethical businesses, you can make a significant impact on the world while maintaining your financial integrity. Look for companies that align with your values, whether that’s environmental sustainability, fair labor practices, or community engagement.

For instance, if you’re passionate about the environment, opt for companies that prioritize sustainability and have eco-friendly practices. When you make purchases from such businesses, you indirectly support their efforts to reduce their carbon footprint. And as a bonus, some of those expenses might even be tax-deductible!

Charitable Contributions with Heart

Charitable donations are a fantastic way to support causes close to your heart while also enjoying some tax benefits. When you give to registered nonprofits, you can often deduct those donations from your taxable income. It’s like getting a little tax reward for doing something good. Just remember to keep records of your donations and ensure the charity you’re supporting is legitimate.

Ethical Investing

Investing can be a powerful way to grow your wealth, but it can also be an opportunity to make a difference. Consider socially responsible investing (SRI) or impact investing. These approaches allow you to put your money in companies and projects that align with your values, whether it’s renewable energy, clean water initiatives, or affordable housing.

SRI can also have tax advantages. For instance, some investments in renewable energy projects can qualify for tax credits, which can reduce your overall tax liability. It’s a win-win – you’re earning potential returns on your investments while supporting causes you believe in.

The Honesty Policy

When it comes to taxes, honesty is truly the best policy. Fudging numbers, hiding income, or engaging in other shady practices might save you a few bucks in the short term, but it’s not worth the long-term consequences. The IRS takes tax fraud seriously, and the penalties can be severe – not to mention the ethical toll it can take on your conscience.

Seek Professional Guidance

Navigating the intricate world of tax laws can be a daunting task. So, don’t hesitate to seek professional guidance. A qualified tax advisor can help you maximize your deductions and credits within the bounds of the law while keeping your tax practices ethical and transparent.

Conclusion: Embrace Ethical Tax Practices

In a world where the lines between right and wrong can sometimes blur, ethical tax practices offer us a clear path forward. Pay your fair share, support ethical businesses, make charitable contributions, invest with purpose, and always remember the honesty policy. By following these principles, you not only navigate the complex tax landscape but also contribute positively to your community and society as a whole.

So, the next time you’re filling out those tax forms or crunching the numbers, do it with integrity and purpose. Remember, ethical tax practices aren’t just about following the rules – they’re about making a positive impact on the world, one tax return at a time. Happy tax season, everyone!