Hello there, fellow financial enthusiasts! I’m Lisa Anderson, and I’ve been sharing my insights on ethical spending for the past four years. Today, we’re diving deep into the world of debt settlement and management, discussing ethical approaches that can help you navigate the tricky waters of indebtedness. So, grab your favorite cup of coffee or tea, settle in, and let’s embark on this enlightening journey.

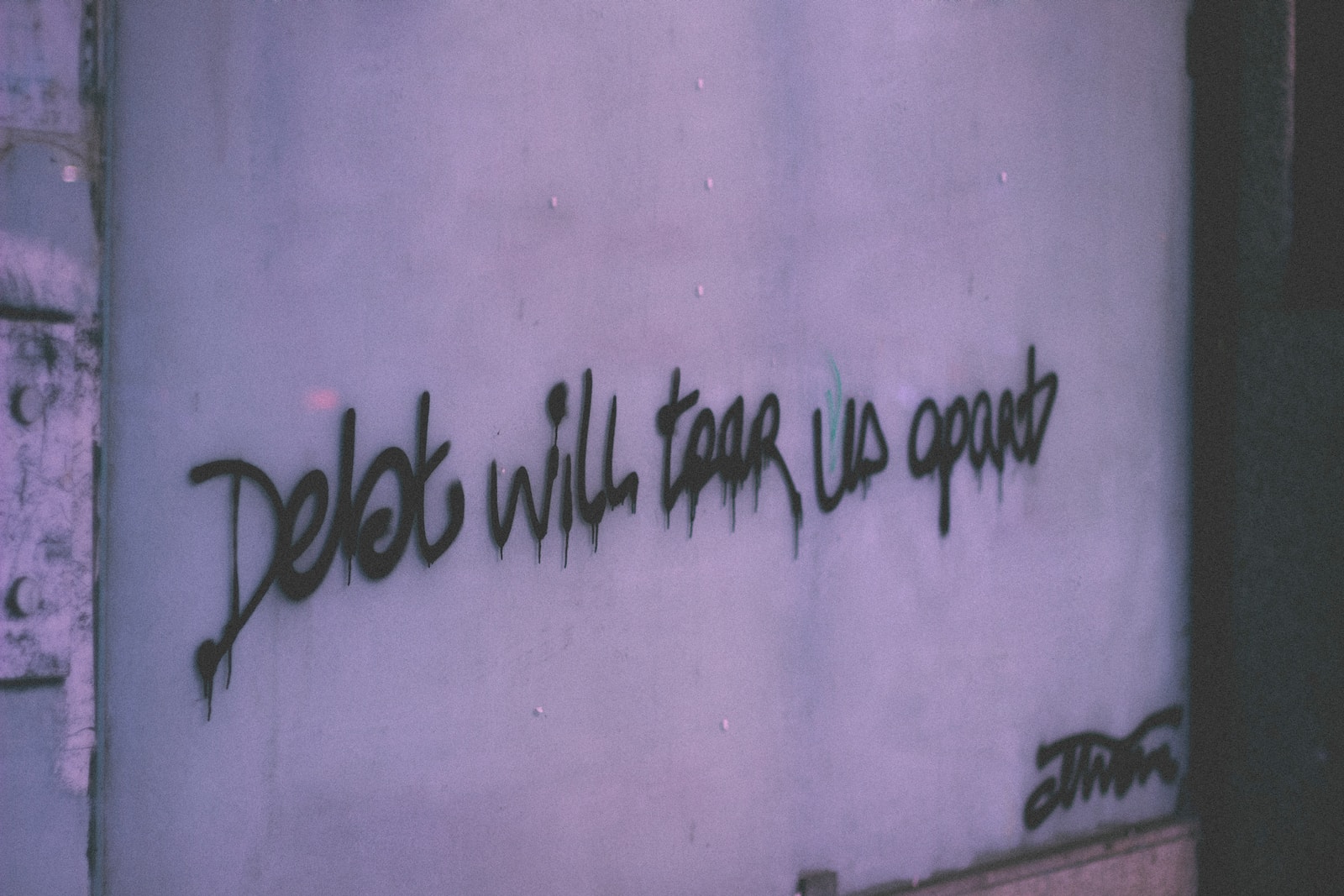

The Debt Dilemma

Debt is a common aspect of modern life. Whether it’s student loans, credit card debt, or a mortgage, most of us have had some experience with it. However, it’s not the existence of debt that’s problematic; it’s how we approach it that truly matters.

Understanding the Ethics

Ethical debt management goes beyond just paying your bills on time. It involves recognizing your responsibilities as a borrower and ensuring that your financial decisions align with your values. So, how can you be ethically responsible when dealing with debt? Let’s explore some key principles and practical examples.

Transparency is Key

When you’re borrowing money, it’s crucial to understand the terms and conditions of the loan. This means reading the fine print, asking questions, and being aware of any hidden fees or penalties. Transparency is not only an ethical obligation but also a means to protect yourself from exploitative lending practices.

Example: Imagine you’re taking out a personal loan to cover unexpected medical expenses. Instead of blindly accepting the first offer that comes your way, take the time to compare different lenders, their interest rates, and repayment terms. This way, you’re making an informed choice that aligns with your financial goals.

Honesty with Creditors

Life can throw unexpected curveballs, making it challenging to meet your financial obligations. When facing difficulties, the ethical approach is to communicate openly and honestly with your creditors. Ignoring phone calls and emails will only exacerbate the situation and damage your credit score.

Example: Suppose you lose your job and can’t make your credit card payments. Instead of avoiding the issue, call your credit card company and explain your situation. They might be willing to work with you by offering temporary relief or a revised payment plan.

Avoid Predatory Lenders

Predatory lending practices prey on vulnerable borrowers, often trapping them in a cycle of debt. Ethical debt management means avoiding such lenders and seeking out reputable financial institutions or nonprofit organizations when you need financial assistance.

Example: Payday loans are notorious for their high-interest rates and aggressive collection tactics. Instead of resorting to a payday lender in a desperate situation, consider alternatives like borrowing from a credit union or seeking assistance from a local community organization.

Prioritize Repayment

Ethical responsibility includes making a genuine effort to repay your debts. Prioritizing repayment not only reflects your commitment to honoring your obligations but also helps you regain control of your financial well-being.

Example: If you have multiple debts, consider creating a repayment plan that focuses on paying off high-interest debts first. This strategy, known as the “debt avalanche,” can save you money in the long run and help you become debt-free sooner.

Financial Education

One of the most ethical things you can do for yourself is to invest in financial education. Understanding how money works, budgeting, and making informed financial decisions can prevent future debt and improve your overall financial health.

Example: Enroll in a personal finance course, attend workshops, or read books and articles on financial management. The knowledge you gain will empower you to make ethical financial choices and avoid falling into debt traps.

Support and Accountability

Managing debt can be a challenging journey. Seek support from friends, family, or support groups. Discussing your financial struggles openly can provide emotional relief and keep you accountable for your financial commitments.

Example: Joining a local financial support group or finding an online community of like-minded individuals can offer valuable insights, encouragement, and accountability as you work toward debt settlement and management.

Charity Begins at Home

Finally, don’t forget to practice ethical spending and saving in your daily life. Living within your means, avoiding unnecessary debt, and making conscious choices about your consumption are all part of the ethical financial package.

Example: Instead of splurging on that designer handbag you can’t afford, consider saving that money for future emergencies or investments. By doing so, you’re being responsible not only to yourself but also to your financial future.

Conclusion

In the world of debt settlement and management, ethics should guide your decisions. Being transparent, honest with creditors, avoiding predatory lenders, prioritizing repayment, investing in financial education, seeking support, and practicing ethical spending are all key components of ethical debt management.

Remember, we all make financial mistakes from time to time, and that’s perfectly normal. What sets us apart is how we choose to address and rectify those mistakes. By following ethical principles and making conscious choices, you can take control of your financial future while maintaining