Hello there, fellow ethical spenders! I’m Nancy Miller, and I’ve been sharing my thoughts on ethical spending for the past four years. Today, let’s dive deep into the world of debt management and how we can align our strategies with ethical standards. Yes, you heard it right – even managing debt can be done ethically!

Now, I know what you might be thinking. Debt is usually considered a financial burden, right? Well, that’s true, but it doesn’t mean we can’t approach it with ethical considerations in mind. In this article, we’ll explore some strategies that allow us to handle our debts responsibly while staying true to our ethical principles.

Start with Responsible Borrowing

The foundation of ethical debt management begins with responsible borrowing. Before you even take on debt, consider whether it’s necessary and how it aligns with your values. Ask yourself questions like:

Is this debt for a genuine need, such as education or a home, or is it for something more discretionary?

Can I realistically afford to repay this debt, taking into account my current financial situation and future earning potential?

Am I choosing a lender or financial institution that aligns with my ethical values?

For example, if you’re passionate about environmental sustainability, you might prefer a lender that invests in green initiatives. By making conscious choices at the borrowing stage, you set yourself up for a more ethical debt management journey.

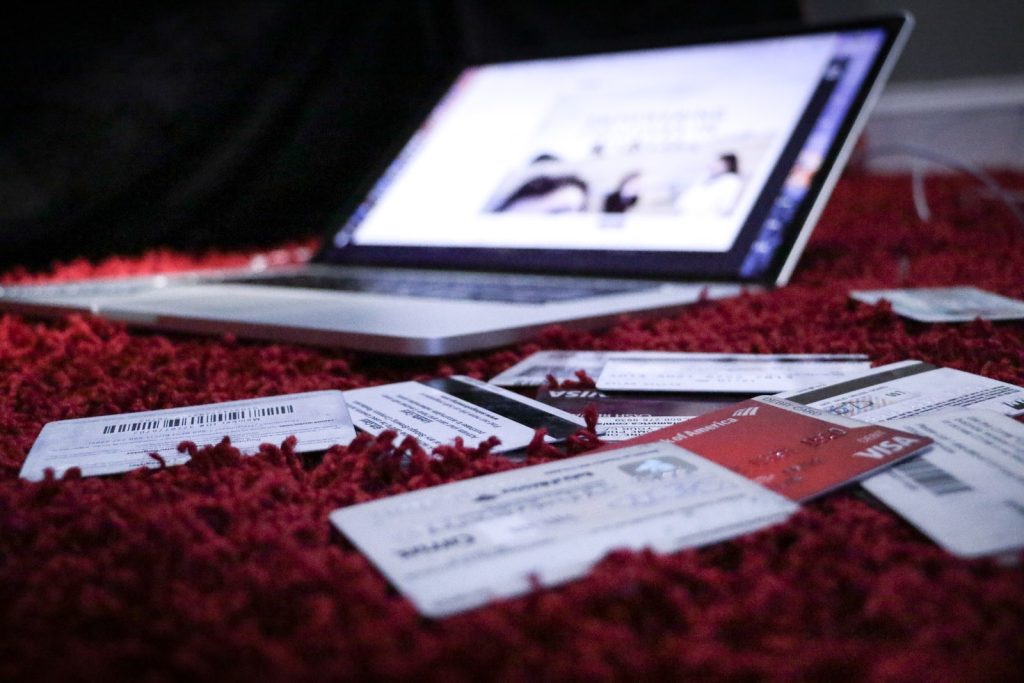

Mindful Credit Card Usage

Credit cards can be both a blessing and a curse, depending on how you use them. To align your credit card usage with ethical standards, here are some tips:

avoid high-interest credit cards that prey on vulnerable customers.

Pay your credit card bills on time to avoid late fees and high-interest charges.

Consider using a credit card with rewards that align with your values, like cashback on eco-friendly purchases or donations to charitable causes.

Prioritize Repayment

When you do have debt, make repaying it a top priority. This doesn’t mean sacrificing your other financial goals, but it does mean being consistent with your repayment efforts. Pay more than the minimum if you can, and allocate windfalls like tax refunds or bonuses toward your debt.

Consider the example of Lisa, who decided to align her debt management with her ethical values. She had a student loan to repay, but she also wanted to support a local food bank. Lisa decided that for every $100 she paid towards her student loan, she would donate $10 to the food bank. This way, she was not only reducing her debt but also making a positive impact on her community.

Ethical Investing for Debt Reduction

Now, here’s an exciting way to align debt management with ethical standards – ethical investing. If you have the means to invest, consider putting your money into ethical investments, such as socially responsible mutual funds or green bonds. As these investments grow, you can use the returns to accelerate your debt repayment.

For instance, imagine you invested in a renewable energy fund, and it performed well. The returns from this investment could be used to pay down your debt faster while supporting the transition to clean energy.

Seek Ethical Debt Consolidation Options

Sometimes, managing multiple debts can be overwhelming. This is where debt consolidation can help. Look for ethical consolidation options that don’t exploit your situation but genuinely help you streamline your payments and reduce your overall interest burden.

Ethical lenders or credit unions often offer consolidation loans with reasonable interest rates and flexible terms. Be sure to do your research and compare options before committing to one.

Maintain Open Communication

In the world of ethical debt management, open and honest communication is key. If you’re experiencing financial difficulties that make it challenging to meet your debt obligations, don’t be afraid to reach out to your creditors. Many financial institutions have hardship programs that can temporarily reduce your interest rates or adjust your repayment schedule.

Avoid Predatory Practices

Lastly, steer clear of predatory practices. These include payday loans, rent-to-own schemes, or any form of lending that preys on vulnerable individuals. These practices often come with exorbitant interest rates and fees that can trap you in a never-ending cycle of debt.

To wrap it up, aligning debt management strategies with ethical standards is not only possible but also a responsible way to navigate the world of personal finance. By making informed decisions, prioritizing responsible borrowing, and seeking ethical solutions, you can manage your debt while staying true to your values.

Remember, ethical debt management isn’t just about financial responsibility; it’s about contributing positively to society and the environment. So, the next time you find yourself facing a financial challenge, approach it with the mindset of an ethical spender, and watch how it transforms your financial journey.

Stay ethical, stay responsible, and keep making a difference with your financial choices!