Hello there, fellow ethical spenders! I’m Nancy Turner, your go-to gal for all things related to ethical spending. Over the past four years, we’ve embarked on a journey together to explore the exciting world of responsible consumption. Today, we’re diving deep into the heart of financial planning and discussing how to weave ethical considerations into this vital aspect of our lives.

When we think about financial planning, we often envision numbers, spreadsheets, and budgeting apps. While these tools are essential, it’s equally crucial to infuse our financial strategy with ethical principles that align with our values and beliefs. After all, money talks, and where it goes matters. So, grab your favorite ethical snack, settle in, and let’s embark on this enlightening journey together.

Why Ethical Financial Planning Matters

Before we dive into the nitty-gritty of integrating ethics into your financial plan, let’s ponder why it’s essential in the first place. Well, my friends, it’s not just about feeling warm and fuzzy inside (although that’s nice too). Ethical financial planning has real-world implications that can benefit you and the planet.

Aligning Values with Money: Your financial plan should reflect your personal values and priorities. By integrating ethics, you ensure that your financial choices resonate with what truly matters to you.

Impact on the Environment: Ethical spending and investment choices can reduce your carbon footprint and contribute to a more sustainable world. Think green energy, eco-friendly products, and socially responsible investments.

Social Responsibility: Ethical financial planning allows you to support companies that uphold ethical labor practices, diversity, and community engagement. You become a conscious consumer and investor, promoting positive change.

Now, let’s roll up our sleeves and get into the practical steps of integrating ethics into financial planning.

Step 1: Define Your Ethical Values

The first step in ethical financial planning is to identify your core values. What causes or issues matter most to you? It could be environmental sustainability, social justice, or fair labor practices. Make a list and prioritize them. These values will serve as your ethical compass in financial decision-making.

Step 2: Assess Your Current Financial Situation

Time for a financial check-up! Analyze your income, expenses, and investments. Take note of where your money is currently going and how well it aligns with your values. You might be surprised by what you discover.

For example, if environmental sustainability is high on your list, scrutinize your energy consumption, transportation choices, and the companies you invest in. Are there areas where you can make more ethical choices?

Step 3: Set Ethical Goals

Now, let’s set some concrete ethical goals. These can be short-term or long-term, depending on your priorities. Maybe you want to reduce your carbon footprint by 20% in the next year, or perhaps you aim to invest a certain percentage of your portfolio in socially responsible funds. Make your goals SMART (Specific, Measurable, Achievable, Relevant, and Time-bound).

Step 4: Revise Your Budget

Budgets may not sound like the most thrilling topic, but they’re the backbone of financial planning. Revise your budget to allocate funds specifically for your ethical goals. For instance, if you want to support local businesses, allocate a portion of your budget to shopping locally or dining at local restaurants.

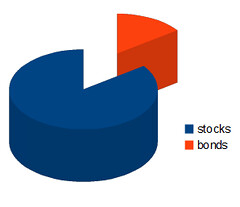

Step 5: Research Ethical Investment Options

If you’re into investing, it’s time to put your money where your values are. Look for ethical investment options such as ESG (Environmental, Social, and Governance) funds, which screen companies based on their ethical practices. This way, your investments can generate both financial returns and positive social or environmental impact.

Step 6: Track Your Progress

Regularly review your financial plan to track your progress toward your ethical goals. Adjust as needed to stay on course. If you find that your spending isn’t aligning with your values, it might be time to reassess your priorities and make necessary changes.

Ethical Financial Planning in Action

Let’s illustrate these steps with a couple of real-world examples:

Example 1: Reducing Carbon Footprint Sarah, an environmentally conscious individual, identifies carbon emissions as her top ethical concern. She starts by assessing her current situation and realizes that her transportation choices, including daily car commutes, contribute significantly to her carbon footprint.

Sarah revises her budget to allocate funds for public transportation, a bicycle, and carpooling. She also begins investing in renewable energy companies through ESG funds. Over time, she reduces her carbon footprint by 25%, all while aligning her finances with her ethical values.

Example 2: Supporting Fair Labor Practices John is passionate about fair labor practices and social justice. He discovers that some of the clothing brands he frequently purchases have been linked to unethical labor conditions in overseas factories.

John revises his budget to allocate funds for clothing purchases from fair-trade and ethically sourced brands. He also switches his investments to companies with strong labor rights records. Not only does John feel good about his choices, but he also helps support fair labor practices in the global fashion industry.

In Conclusion

Integrating ethical considerations into financial planning is a powerful way to make a positive impact on the world while aligning your financial goals with your values. It might take some effort and adjustment, but the rewards are well worth it.

Remember, ethical financial planning is a journey, not a destination. As you navigate this path, stay true to your values, adapt your plan as needed, and keep striving for a more ethical and sustainable financial future. Together, we can make a difference—one ethical choice at a time.